Legal professionals lose an estimated $2,500–$7,000 each year by paying for dental, medical, and vision expenses with personal after-tax income — for themselves and their families.

Whether you’re looking for plans for just yourself and your family, or sponsoring a plan for your employees, Wellbytes has a flexible solution for you!

Stop paying for medical, dental, and family health expenses using after tax income. Redirect those costs through your corporation with a CRA-approved HSA and keep thousands more each year.

Wellbytes helps Legal Professionals Reduce Personal Taxes

And Keep Thousands Annually

Want to speak to someone right away? Call 1-888-218-4549

See the breakdown on how a real life Wellbytes customer saved on IVF treatments, helping them start their family.

| Without HSA | With Wellbytes HSA |

|---|---|

| Pay medical expenses with fully taxed income | Use pre-tax Corporate to Business dollars |

| $2,500 expense = $4,000+ billable income needed | $2,500 expense = $2,500 tax-free claim |

| No deductions available | 100% deductible through your corporation |

| You keep less of your billable income | You keep more of your billable income |

Business structure validation and 100% of claims are reviewed to ensure compliance

No setup, renewal, cancellation or dependent addition fees.

All invoices and claims are stored securely and can be provided for audits

Pay less taxes and keep more of your income

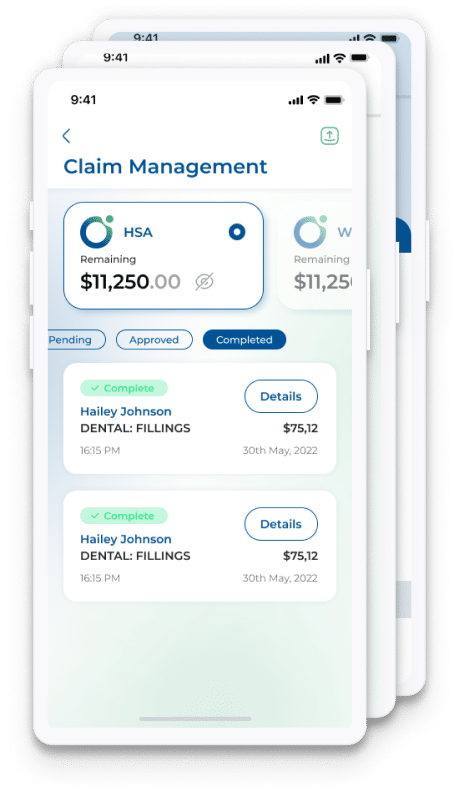

Submit claims in seconds and be reimbursed within 1 business day

Extend coverage to your spouse and eligible dependents at no extra cost

No tied selling. No cross-selling. Period.

Get real-time updates on claims and reimbursements

Look for transparent fee structures to ensure no enrollment fees, per employee and dependent fees or hidden cancellation fees

Understand who owns the administrator to consider their primary offering. Will they prioritize selling insurance or other products?

Look for an administrator that provides a digital and easy claim experience

No cutting corners. Look for an administrator that reviews all claims instead of conducting audits and spot checks after claims are submitted.