The landscape of employee benefits is undergoing a profound transformation across Canada, largely driven by advancements in digital technology. A digital health benefits platform Canada offers a modern, flexible alternative to traditional insurance models, aligning well with the needs of contemporary businesses.

These platforms enable organizations to deliver more personalized, cost-effective, and easily manageable health and wellness benefits, adapting seamlessly to various size businesses and regional requirements. As Canadian companies seek smarter ways to support their employees, embracing digital solutions has become not just advantageous but essential in staying competitive.

In this comprehensive article, we delve into what constitutes a digital health benefits platform in Canada, explore its core advantages, review relevant local examples, analyze cost implications through scenarios, and outline the practical steps for implementation. By understanding the intricacies of these platforms, you can make informed decisions that maximize employee wellness while maintaining budget control.

Whether you’re a startup in Toronto, an SME in Alberta, or a large corporation, this guide aims to assist you in selecting the right digital health benefits platform Canada offers, ensuring your benefits strategy is both innovative and compliant.

Introduction

Why Canadian Businesses Are Moving from Traditional Insurance to Digital Health Benefits Platforms

In recent years, Canadian businesses have increasingly shifted towards digital health benefits platforms, reflecting broader trends in digital transformation and employee-centric benefits management. Traditional group insurance policies, while still prevalent, often involve lengthy administrative processes, inflexible coverage options, and limited customization — all of which can hinder their effectiveness in today’s fast-paced business environment.

The increasing complexity of healthcare needs, combined with rising premium costs, compels companies to explore more adaptable solutions. Digital health benefits platforms address these issues by providing online benefits management that is both user-friendly and scalable, leveraging technology to streamline processes and improve employee experiences.

Moreover, the flexibility offered by these platforms allows businesses to tailor benefits to individual preferences, whether they prioritize medical services, wellness programs, or a combination.

Canadian businesses, especially startups, SMEs, and innovative enterprises, recognize the importance of offering competitive benefits packages that attract and retain talent. Digital platforms enable them to provide budget-friendly employee benefits that are easier to administer and align with corporate sustainability goals.

These benefits go beyond convenience, offering opportunities for cost savings, enhanced reporting, and better engagement, ultimately fostering healthier, more satisfied workforces.

How to Identify and Evaluate the Right Digital Health Benefits Platform

Navigating the growing array of digital health benefits platforms available in Canada can seem daunting. Companies must consider various factors such as platform features, compliance with Canadian regulations, integration capabilities, user experience, and cost. Understanding what makes a platform suitable for your specific needs is crucial in making an informed choice.

Evaluating your organization’s requirements includes assessing employee demographics, health and wellness priorities, budget constraints, and existing HR systems. Are your employees more interested in health or wellness perks? Do you need a platform that integrates seamlessly with payroll and HR management tools? What level of reporting and analytics do you expect from the platform? These questions help narrow down options and identify a platform that aligns with your strategic goals.

Support keywords such as online benefits management Canada and budget-friendly employee benefits can assist in conducting targeted research. By focusing on these aspects, you ensure that the digital health benefits platform you choose not only enhances employee satisfaction but also provides long-term value.

As this market continues to evolve, staying informed about recent innovations, compliance requirements, and regional adaptations is vital for success. Whether you are new to digital solutions or seeking to upgrade an existing program, a thorough evaluation process helps you select a platform that is reliable, scalable, and compliant with Canadian regulations.

What Is a Digital Health Benefits Platform?

A digital health benefits platform is an online software solution that enables organizations to administer, manage, and optimize health and wellness benefits for their employees through a centralized digital interface. These platforms replace traditional paper-based processes and manual administration, offering a streamlined, automated, and accessible way to handle benefits programs.

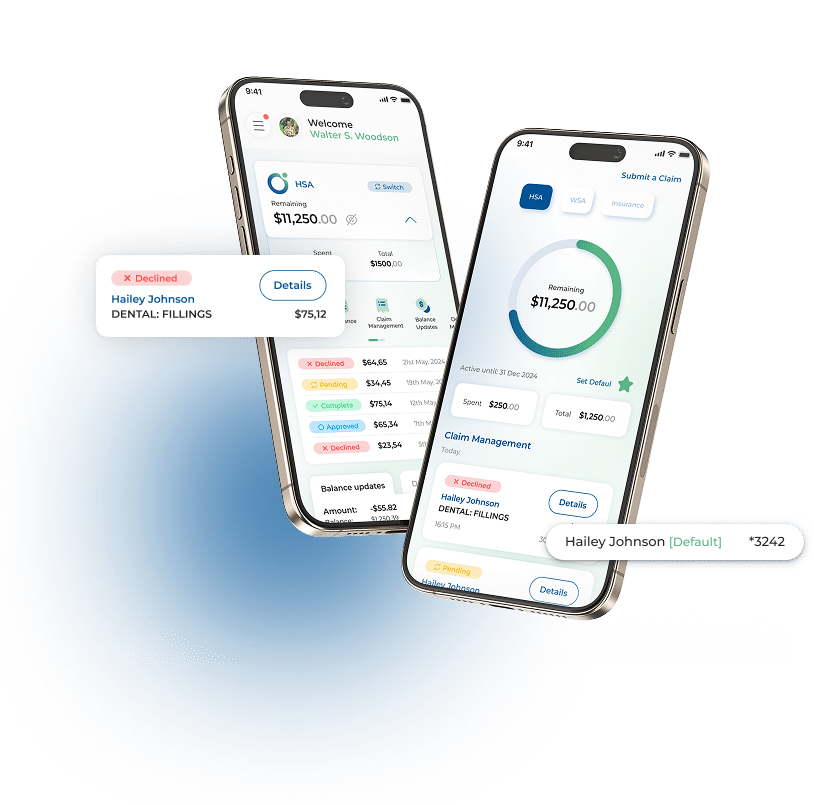

Typically, such platforms feature an easy-to-navigate dashboard where employees can review their benefits options, submit claims or reimbursements, and track their health expenses in real time. Employers can configure the system to enforce policies, monitor usage, and generate detailed reports, fostering transparency and efficiency.

The core advantage lies in providing a comprehensive ecosystem that consolidates various benefit components—health insurance, wellness stipends, health savings accounts (HSAs), and wellness perks—into a single, user-friendly platform.

What differentiates a digital health benefits platform from traditional group insurance or Health Savings Accounts (HSAs) is its flexibility and scalability. Unlike static insurance plans, these platforms allow workers to customize their health and wellness spending within predefined budgets, adapt benefits as needs evolve, and facilitate quick reimbursements through digital apps. They are designed to accommodate regional nuances and regulatory requirements, making them especially suitable for Canadian firms with diverse employee bases.

How Does It Differ from Traditional Group Insurance and HSAs/WSAs?

Traditional group insurance plans are typically employer-sponsored policies with fixed coverage options, premiums, and benefit limits. These plans often involve complex paperwork, rigid policies, and limited flexibility, posing challenges for both employees and HR teams. Employees might find themselves unable to tailor plan features to their personal needs, and administrators face time-consuming processes to manage claims and compliance.

Health Savings Accounts (HSAs) and Wellness Spending Accounts (WSAs), on the other hand, are more flexible tools that focus on individual reimbursement of eligible expenses. However, these accounts usually come with specific limits, tax implications, and administrative requirements. For instance, while HSAs are tax-advantaged and offer more control, they often necessitate detailed expense tracking and compliance oversight.

The digital health benefits platform bridges these gaps by blending the flexibility of HSAs/WSAs with the comprehensive administrative capacity of traditional insurance. It enables organizations to offer a combination of medical benefits and wellness spending rights on a single platform, with automation handling eligibility, claims, and reporting, all in compliance with Canadian regulations. This integrated approach simplifies benefit administration, enhances employee experiences, and allows businesses to be agile in their benefits offerings.

Why Are Digital Platforms the Future of Employee Benefits in Canada?

The future of employee benefits in Canada is inherently digital, driven by the need for increased flexibility, efficiency, and personalization. Digital platforms support remote work, enable real-time claim processing, and facilitate better engagement through mobile apps and user portals. Canadian regulators are also expanding guidelines that recognize digital solutions as compliant, provided they meet security and privacy standards.

The increasing adoption of AI and data analytics within these platforms allows for smarter benefits management, including predictive insights on employee health trends, personalized wellness suggestions, and targeted interventions. These innovations not only improve health outcomes but also optimize costs for employers.

Moreover, Canadian startups and SMEs are leading the charge, leveraging cost-effective digital benefits as an attractive element of their compensation packages. As more organizations recognize the advantages of digital health benefits platforms, their growth and sophistication are expected to accelerate, further integrating into core HR systems, payroll, and compliance frameworks.

In essence, embracing digital solutions today sets a foundation for a resilient, adaptable, and happier workforce tomorrow. It aligns with broader trends in health tech and corporate sustainability, positioning Canadian businesses at the forefront of innovative employee care.

Key Benefits Of Digital Health Benefits

Centralized Online Management for Employers

Managing employee benefits through a centralized online platform significantly simplifies HR operations. Instead of juggling multiple paper documents, spreadsheets, and manual approvals, employers can access all benefit information in one secure dashboard. This not only reduces administrative burdens but also minimizes errors and ensures compliance.

The platform enables HR teams to set benefit parameters, monitor claims in real-time, and generate detailed reports at a glance. Changes to benefit policies can be implemented instantly without costly bureaucratic procedures. This agility allows organizations to respond quickly to evolving employee needs or regulatory requirements, enhancing operational efficiency.

Furthermore, centralized management through digital platforms facilitates better communication with employees. Automated notifications about claim statuses, benefit updates, or upcoming wellness programs foster engagement and transparency. In particular, Canadian companies operating across provinces with different healthcare regulations appreciate the ease of managing compliance and benefit specifics within a single digital environment.

Employee Flexibility: Choose Health vs. Wellness Spending

One of the most compelling features of digital health benefits platforms is promoting employee choice. Employees can select how to allocate their benefits budgets between health expenses, wellness programs, or a combination thereof, based on their individual needs. This level of customization enhances satisfaction, especially as health priorities vary across age groups, lifestyles, and personal circumstances.

For example, some employees might prioritize coverage for prescriptions, dental, or physiotherapy, while others may prefer stipends for fitness memberships, mental health apps, or nutritional counseling. Digital platforms often allow employees to manage their benefits through intuitive apps, submitting claims or receipts digitally, and tracking their expenses effortlessly.

This flexibility aligns with modern expectations for personalized benefits, drives engagement, and encourages healthier lifestyles. Employers that support such personalized choices demonstrate empathy and support that can boost morale and loyalty, especially in a competitive talent market.

Budget Control for Businesses

Cost management is a critical concern for Canadian businesses of all sizes. Digital health benefits platforms provide granular control over benefit budgets, enabling organizations to set spending limits, define eligible expenses, and monitor financial utilization in real time. This capability ensures expenditures stay within budget, prevents fraud, and helps allocate resources more effectively.

Employers can design benefit packages that are financially sustainable, perhaps offering a base subsidy with optional add-ons for employees to customize their benefits. Automated features enable alerts when nearing preset limits or unusual activity, adding an extra layer of financial safeguards. Such control is particularly crucial for smaller companies or startups that operate with tighter budgets but want to remain competitive.

Over time, data collected through these platforms can inform strategic decisions on benefits offerings, showing which programs are most utilized or impactful. This analytical approach ensures that the benefits provided genuinely support employee health and productivity, optimizing return on investment.

Cost Savings vs. Insurance Premiums

Switching from traditional insurance models to digital health benefits platforms often results in significant cost savings. Premiums for group insurance policies tend to rise annually, squeezed further by claim costs and administrative overhead. Digital platforms, especially those utilizing HSAs or WSAs, facilitate a shift toward more self-directed spending, reducing insurer dependency.

By empowering employees to manage their health expenses directly, organizations can better control costs and avoid overpaying for coverage that may not align precisely with employee needs. Additionally, wellness-focused benefits can prevent health issues before they require costly treatments, indirectly lowering insurance premiums.

Cost savings also extend to administrative expenses. Automating claims processing, reporting, and compliance reduces labor costs and error rates. These savings make digital benefits platforms an attractive investment, especially for cost-conscious organizations seeking to offer competitive benefits without escalating expenses.

Quick Reimbursements Via Digital Apps

Speed and convenience are vital in modern benefits management. Digital health benefits platforms enable employees to submit claims and receive reimbursements quickly via mobile apps or online portals. This immediate access improves employee satisfaction, reduces frustration, and encourages the utilization of benefits.

In practical terms, employees can upload receipts, verify claim details, and track reimbursement status within minutes. Digital notifications notify users of claim approval or issues requiring attention, streamlining workflows. Faster reimbursements also support better financial planning for employees, as they can access funds promptly for urgent healthcare needs.

For Canadian organizations, timely reimbursements demonstrate a commitment to employee well-being, which can enhance engagement and brand reputation. These digital apps also facilitate ongoing improvements through user feedback and analytics, ensuring the platform remains responsive and intuitive.

Relevant Examples

Tech Startups in Toronto Adopting Digital Platforms

Toronto’s vibrant tech startup ecosystem exemplifies the adoption of digital health benefits platforms. These companies often prioritize agility, cost-efficiency, and employee-centric benefits to attract top talent. By integrating platforms like Wellbytes or similar Canadian providers, startups can offer flexible, scalable benefit solutions without the cumbersome overhead associated with traditional insurance.

These organizations leverage digital platforms to tailor benefits, particularly targeting young professionals who value wellness, mental health, and work-life balance. For many startups, implementing digital benefits has become a key differentiator in talent recruitment and retention, reflecting their innovative culture.

Additionally, Toronto’s diverse, multicultural workforce often requires flexible benefits structures that cater to various health needs and brand transparency. Digital platforms facilitate customization, regional compliance, and multilingual support, making them an ideal fit for such dynamic environments.

Regional Adaptability: SMEs in Alberta Using Online Tools for Cost-Effective Benefits

Small and medium-sized enterprises (SMEs) in Alberta have been quick to adopt online health benefits management platforms. With regional variations in healthcare service access and costs, these companies benefit from digital solutions that offer flexibility and affordability.

Alberta’s SMEs are leveraging these platforms to implement Wellness Spending Accounts or Health Spending Accounts that align with provincial regulations. These tools allow employees to allocate funds toward mental health, physical therapy, or preventative care, tailored to regional costs and needs.

Furthermore, local providers understand the unique challenges faced by Alberta businesses, offering solutions that integrate with provincial health plans and tax policies. This regional adaptability enhances the appeal of digital health benefits and supports the goal of providing sustainable, budget-friendly benefits plans.

See our guide on Health Spending Account in Canada

Cost Breakdown with Scenario

Example Scenario: A 20-Employee Business vs. Traditional Insurance

Small businesses often face tough decisions regarding benefits affordability. Consider a typical scenario: a business with 20 employees evaluating traditional insurance policies versus digital platforms with HSA/WSA options.

| Aspect | Traditional Group Insurance | Digital Platform with HSA/WSA |

| Per Employee Cost | ~$400/month | ~$250/month, flexible usage |

| Total Monthly Cost | ~$8,000 | ~$5,000 |

| Annual Cost | ~$96,000 | ~$60,000 |

| Flexibility for Employees | Limited | High (choose health or wellness spending) |

| Administrative Time | High | Low (automated claims and reporting) |

| Reimbursements | Slow (paper-based / manual) | Quick via mobile apps |

| Employee Satisfaction | Moderate | High |

This simplified comparison illustrates how digital solutions can significantly reduce costs while offering greater flexibility. These savings are especially relevant for smaller firms that seek competitive benefits without ballooning expenses.

Potential Cost Savings and ROI

Beyond direct savings, organizations benefit from improved employee health outcomes, higher engagement, fewer sick days, and lower turnover — all contributing to a healthier bottom line. The initial investment in a digital health benefits platform often pays for itself within months, especially through administrative efficiencies and increased employee satisfaction.

Cost-effective benefits are an essential component of sustainable business practices, and investing in digital solutions positions companies for long-term success while supporting a healthier, happier workforce.

Step-by-Step Process

Assessing Employee Needs

Before selecting a digital health benefits platform, organizations should conduct a comprehensive assessment of employee needs. This involves gathering data on common health and wellness priorities—such as mental health support, physical therapy, or nutritional counseling—and understanding demographic factors like age, health status, and regional differences.

Engagement surveys, focus groups, and HR data analysis can help identify gaps and preferences. This step is crucial because it ensures the platform chosen aligns with actual employee requirements, leading to higher utilization and satisfaction.

Furthermore, understanding specific regulatory considerations within Canada and across provinces ensures compliance from the outset. Local nuances in healthcare coverage or tax rules should influence the benefit design to optimize value and adherence.

Choosing a Provider: Spotlight on Wellbytes

Selecting the right provider for a digital health benefits platform in Canada requires careful evaluation of feature sets, compliance, security, customer support, and pricing. Wellbytes, for example, is a prominent Canadian provider specializing in flexible health spending accounts and modular benefits platforms.

When vetting providers, consider whether they offer seamless integration with your existing HRIS or payroll systems, mobile-friendly interfaces, and robust reporting capabilities. Certified compliance with Canadian privacy laws and CRA rules is non-negotiable to protect sensitive employee data and ensure eligibility.

It’s wise to request demos, review case studies, and seek references within your industry. A good provider will demonstrate adaptability to your organization’s size, region, and culture, helping you build a benefits program that truly works.

Setting a Budget and Launching

Once a platform is selected, establish an annual benefits budget per employee, considering both the organization’s financial capacity and expected employee utilization. Clearly define what expenses are covered, whether health, wellness, or both, to avoid misaligned expectations.

Launching the platform involves creating onboarding materials, training HR staff, and communicating benefits clearly to employees. An effective rollout maximizes engagement and ensures employees understand how to utilize their new digital benefits.

Post-launch, HR teams should regularly track claims, reimbursement patterns, and user feedback. These insights help optimize benefit offerings, resolve issues promptly, and demonstrate ROI to stakeholders.

Tracking Reimbursements and Reporting

Continuous monitoring of reimbursement activities and benefit utilization is vital for maintaining efficiency and regulatory compliance. Modern digital platforms provide detailed analytics dashboards showing claim trends, high-cost areas, and employee engagement levels.

Regular reporting enables organizations to identify underused benefits, detect potential fraud, or adjust benefits to better meet employee needs. These insights also support strategic planning, such as introducing new wellness initiatives or refining existing programs.

Automation in tracking and reporting reduces administrative overhead and allows HR teams to focus on strategic initiatives, improving overall benefits management.

Rules & Compliance

CRA Compliance: Ensuring Eligible Medical Expenses Are Covered

In Canada, the Canada Revenue Agency (CRA) sets strict rules regarding what constitutes eligible medical expenses for tax deduction and reimbursement purposes. Digital health benefits platforms must ensure that claims processed through their systems adhere to these guidelines to prevent non-compliance and potential penalties.

Eligible expenses typically include prescriptions, dental work, physiotherapy, mental health counseling, and diagnostic services. Platforms should incorporate built-in compliance checks, clear expense categorization, and consistent updates based on CRA changes.

Employers should educate employees about what expenses qualify and the documentation required for reimbursements, thereby reducing claim rejections and ensuring adherence to legal standards.

WSA Coverage: Wellness Perks but Not Tax-Deductible

Wellness Spending Accounts (WSAs) are designed to fund non-medical perks such as gym memberships, wellness apps, and mental health programs. While these benefits enhance employee wellbeing, they are not tax-deductible for employers under current CRA guidelines, which distinguishes them from traditional medical expenses.

Platforms supporting WSAs need to clearly delineate eligible wellness benefits and communicate tax implications to employees. Proper categorization ensures compliance and transparency, avoiding inadvertent tax issues.

Employers should also consider the strategic use of WSAs to boost engagement and morale, understanding that they serve a different purpose than medical benefits and require tailored management.

FAQ: Is a Digital Benefits Platform CRA-Approved? What Expenses Are Covered in 2025? Are WSAs Taxable?

Q: Is a digital benefits platform CRA-approved? A: Digital platforms are compliant if they accurately process eligible expenses and adhere to privacy standards, but approval depends on the benefits structure and adherence to CRA rules. Always select providers experienced in Canadian compliance.

Q: What medical expenses qualify under CRA in 2025? A: Generally, expenses such as prescriptions, dental treatments, physiotherapy, mental health services, and diagnostic procedures are eligible. Stay updated with CRA guidelines as policies may evolve.

Q: Are WSAs taxable in Canada? A: Typically, benefits from WSAs are considered taxable benefits unless specifically designated as non-taxable wellness programs. Clear communication and proper classification are essential.

Future Trends that Wellbytes predict

Growth of AI-Driven Benefits Management

Artificial Intelligence (AI) is poised to revolutionize benefits management by enabling predictive analytics, personalized wellness programs, and automated claim processing. AI algorithms can analyze employee health data anonymously to identify risk patterns and suggest targeted interventions, resulting in healthier workforces and reduced costs.

In the Canadian context, privacy and security remain paramount, but AI-driven insights can lead to more proactive, preventive healthcare strategies. Companies that adopt AI tools embedded within their digital platforms will likely gain a competitive edge by offering smarter, more responsive benefits.

Increased Adoption by SMEs and Startups

SMEs and startups are leading the charge in adopting digital health benefits platforms, recognizing their cost-effectiveness and flexibility. These organizations typically lack the infrastructure for complex traditional insurance schemes, making digital solutions essential for offering appealing benefits without overspending.

As digital literacy improves and platforms become more intuitive, adoption rates are expected to accelerate. This democratization of benefits management also allows smaller firms to compete with larger corporations in talent attraction and retention.

Integration with Payroll and HR Software

The future of digital health benefits platforms includes seamless integration with payroll, HR management systems, and even EHR (Electronic Health Record) systems. Such interoperability enhances operational efficiency, reduces errors, and fosters a holistic approach to employee wellbeing.

Canadian companies will increasingly seek platforms that can synchronize data across multiple systems, providing comprehensive insights and simplifying compliance with tax regulations, privacy laws, and reporting requirements.

Conclusion

The shift toward digital health benefits platform Canada is undeniable, driven by technological innovation, employee expectations, and the need for cost-effective, flexible solutions. These platforms offer central management, customizable benefits, rapid reimbursements, and regulatory compliance—key factors in designing efficient benefits strategies.

Canadian startups, SMEs, and large corporations are leveraging these tools to enhance employee wellbeing, improve operational efficiency, and control costs. As future trends like AI integration, widespread adoption, and system interoperability unfold, digital benefits management will become even more integral to progressive organizational policies. If you’re seeking a budget-friendly, adaptable, and compliant solution, exploring options like Wellbytes can help you craft a premier, future-ready benefits package.

Compare Wellness Spending Account vs. Health Spending Account for more clarity. And, to understand how to launch your program effectively, learn how to set up employee health benefits in Canada. With the right digital platform, your organization can foster a healthier, happier workforce that drives success for years to come.